Obtain Access to Immediate Online Loans Via Trusted Finance Services for Financial Support

In times of monetary need, accessing instantaneous on-line financings via trusted lending services can be an important source for people looking for financial aid. These funding services supply a convenient way to secure funds quickly, offering a remedy to unanticipated costs or immediate monetary obligations. Browsing the landscape of on-line finances needs a detailed understanding of the process, qualification standards, and terms entailed to make enlightened choices. By exploring the benefits of instantaneous on-line lendings, the qualification demands, and the application procedure, individuals can acquire insight right into just how these solutions can use prompt monetary assistance. Understanding the nuances of taking care of loan repayment is likewise crucial for preserving monetary stability.

Benefits of Immediate Online Loans

Instant on-line car loans offer a practical and reliable economic service for individuals looking for quick accessibility to funds. One vital advantage of immediate online fundings is the rate at which the entire process can be completed. Unlike standard small business loan that may take weeks to process, on the internet loans can often be accepted within minutes, giving borrowers with the prompt economic aid they require. Additionally, the on-line application process is usually uncomplicated and can be completed from the convenience of one's home or office, conserving time and removing the demand for in-person visits to a bank or loan provider.

An additional benefit of immediate on the internet car loans is the access they offer to a larger array of debtors. Online finance services usually supply transparency pertaining to charges, rate of interest prices, and settlement terms, encouraging consumers to make informed choices concerning their financial dedications.

Eligibility Criteria for Online Loans

When thinking about qualification for online car loans, candidates are normally needed to meet particular standards to receive economic assistance. These criteria may vary depending upon the lender and the sort of funding being requested. Typical eligibility requirements consist of being of lawful age, which is normally 18 years of ages or older, having a stable income source, and being a local in the country where the lending is being offered. Lenders might likewise take into consideration the applicant's credit report to analyze their creditworthiness and capability to pay off the finance. Additionally, some lenders might need applicants to provide specific papers such as recognition evidence, bank declarations, and evidence of work. Satisfying these eligibility requirements is vital for a successful lending application and getting the economic support required. It is a good idea for potential borrowers to thoroughly assess the qualification demands of different lenders prior to getting an on the internet car loan to enhance their opportunities of authorization and safe and secure favorable terms.

Application Refine for Quick Loans

The procedure of getting quick fundings includes sending an in-depth on-line application form. To start the application procedure, individuals commonly require to give individual info such as their full name, contact details, work condition, revenue details, and banking details - Easy to find a Fast Online Payday Loan. This details assists the finance company analyze the applicant's qualification and figure out the lending quantity that can be used

After the application is evaluated and accepted, the candidate is informed of the financing decision, consisting of the approved car loan amount, rate of interest, and repayment terms. Upon approval of the loan offer, the funds are normally disbursed promptly, typically within the exact same day or following business day, giving consumers with the economic help they require in a timely way.

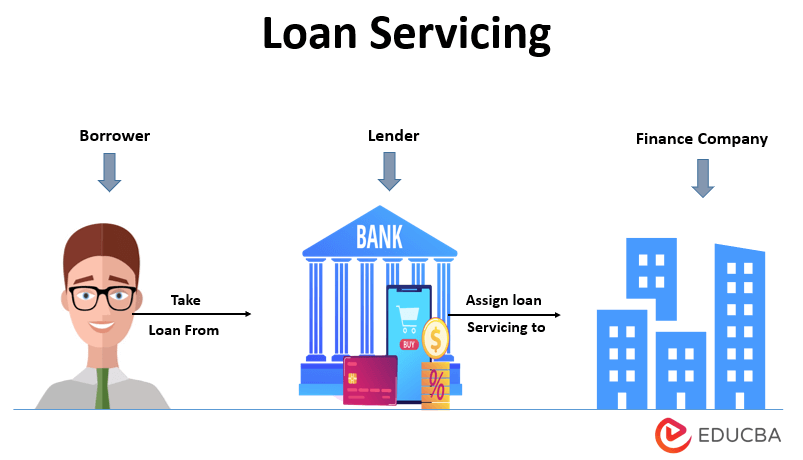

Recognizing Loan Terms

Upon completion of the application procedure for quick finances and obtaining authorization, it comes to be important for borrowers to meticulously evaluate and comprehend look what i found the financing terms offered by the funding solution company. Understanding the loan conditions is vital to ensure that debtors are fully knowledgeable about their rights and duties relating to the borrowed funds. These terms generally consist of details such as the lending quantity, rates of interest, payment schedule, charges, and any fines for late repayments or defaults.

Consumers must pay very close attention to the passion rate billed on the lending, as it straight impacts the general cost of borrowing. In addition, comprehending the settlement schedule is crucial to avoid any type of possible financial stress and ensure timely settlements (payday loans). It is vital to clarify any type of uncertainties with the finance company to avoid misconceptions or problems in the future

Handling Payment of Online Loans

Navigating the payment procedure for on-line lendings needs thorough preparation and adherence to the agreed-upon terms. As soon as you have actually availed yourself of an online car loan, it is vital to develop a settlement timetable that aligns with your financial capabilities. By handling the payment of your on the internet finance sensibly, you can efficiently accomplish your financial obligations and build a positive relationship with your lending service provider.

Verdict

Finally, instant on the internet loans provide a convenient and quick remedy for those seeking monetary aid. By satisfying the check this site out eligibility standards and comprehending the lending terms and problems, customers can access funds easily with trusted finance services. It is very important to handle the settlement of online financings properly to stay clear of monetary troubles in the future.

In times of financial requirement, accessing instant on the internet loans with relied on lending solutions can be a valuable resource for people looking for monetary assistance. Unlike standard financial institution car loans that might take weeks to procedure, online fundings can often be authorized within mins, giving customers with the instant economic aid they require.Upon conclusion of the application procedure for fast lendings and getting authorization, it comes to be essential for customers to very carefully assess and understand the lending terms and conditions supplied by the financing solution provider. By managing the repayment of your on the internet funding sensibly, you can efficiently accomplish your economic commitments and construct a favorable partnership with your loan service provider.

By satisfying the eligibility criteria and understanding the lending terms and conditions, borrowers can access funds easily through relied on loan solutions. - Online payday loans